By Adam N. Rabinowitz

Farming comes with a variety of business risks that have the potential to significantly affect the operation and farm family. Some of these risks are related to production activities, such as the impact of weather, pests and diseases. Other risks are borne from the broader economy and do not start with what happens on the farm.

Inflation is one of the risks that presents a threat to the financial health of the farm. As the U.S. inflation rate has been one of the biggest stories of the past two years, it is important to understand how this can impact farm finances and what financial risk management strategies can be considered to help manage that risk.

Inflation

Inflation is measured by the consumer price index and reflects the annual percentage change in the average cost of goods and services in an economy. More fundamentally, a higher rate of inflation means that we receive less when spending the same dollar. When considering production input costs, that means the inputs become more costly. However, inflation is not necessarily a bad thing. A steady low level of inflation, usually about two percent, fuels economic growth.

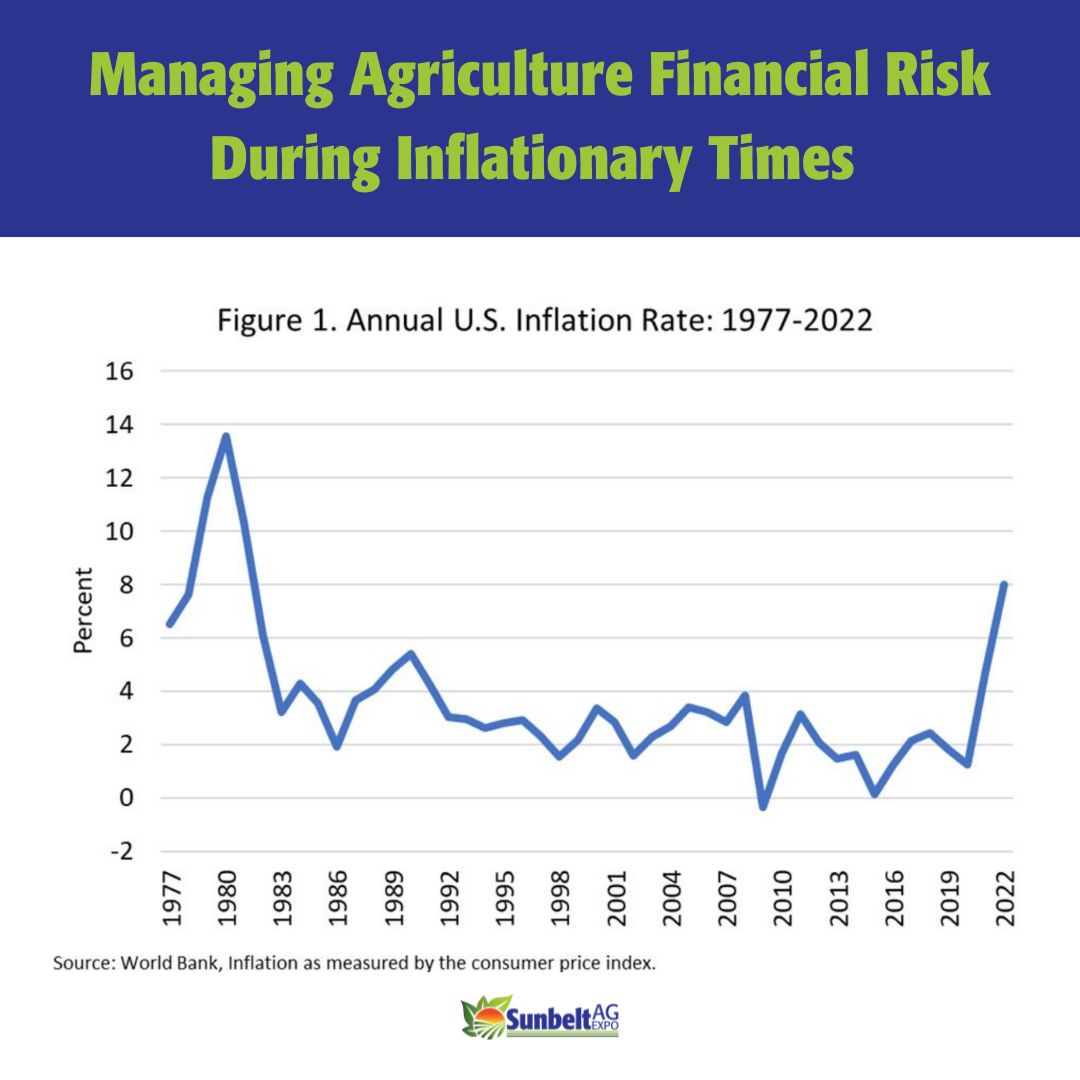

Figure 1 shows the annual inflation rate in the U.S. from 1977 to 2022. While a target 2% rate is ideal, there is a lot of fluctuation around that rate. At times the inflation rate has even dipped slightly negative, such as in 2009. However, since 1992 the most significant deviation from the target rate has come from the sharp increase in inflation since 2021, with the annual inflation rate reaching 8% in 2022. The last time the inflation rate was this high was in the late 1970s and early 1980s. In response to high inflation rates, monetary policy is used to bring the rate closer to the desired target.

Interest Rates

The Federal Reserve System of the U.S. is responsible for U.S. monetary policy, which includes controlling the inflation rate in the U.S. economy. More specifically, the Federal Open Market Committee of the Federal Reserve System meets regularly to make decisions about where to set the Federal Funds Rate. The Federal Funds Rate is the interest rate that banks charge each other when lending excess reserves. The FOMC uses the Federal Funds Rate as a monetary policy tool to control inflation. As the Federal Funds Rate changes, it triggers changes in interest rates and other activity in the economy.

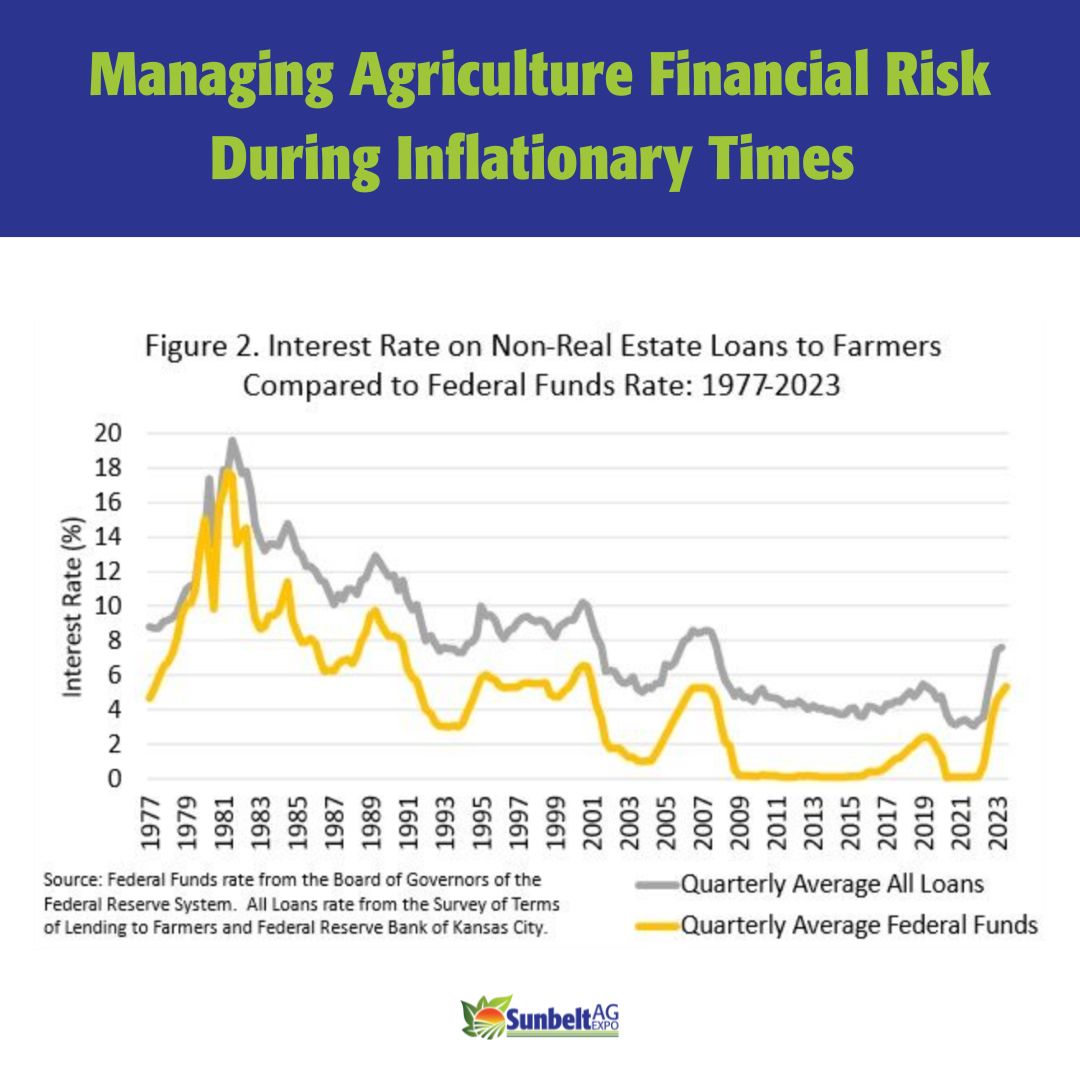

Figure 2 shows the Federal Funds Rate from 1977 to 2023. The average Federal Funds Rate has increased from near 0% to 5.33% from the beginning of 2022 through mid-2023. This is the highest rate since the beginning of the 21st century.

However, many may recall the early 1980s when the average quarterly Federal Funds Rate peaked around 18%, shortly after the inflation rate peaked just under 14% (Figure 1). The current Federal Funds Rate and inflation rate are far from those peaks, and neither are expected to increase to those levels. However, the current Federal Funds Rate is in line with the rates seen during most of the 1990s.

Increases and decreases in the Federal Funds Rate have a direct impact on farmers as the interest rate for non-real estate farm loans, shown in Figure 2, has moved in near unison since the 1980s. These farm loans are used for the purchase of machinery and equipment, livestock, crop production inputs, and other operating expenses.

Over the last ten years, U.S. farmers have had outstanding non-real estate farm loans at commercial banks averaging between $65 and $75 billion as reported in the 2023 Reports of Condition and Income and Federal Reserve Bank of Kansas City. During this period, interest rates on non-real estate farm loans reached an all-time quarterly average low of 3.6% in 2015.

After a steady climb to 5.5% in 2019, the rate dropped to near 3% as a result of Covid-19 monetary policy. As of the second quarter of 2023, the average farm loan rate was 7.6%, which was prior to the last 0.25% Federal Funds Rate increase in July 2023. The last time rates were this high was in 2007. While this is a recent peak, it is still much lower than the rates seen in the early 1980s that approached a quarterly average of 20%.

While increasing interest rates can make taking on new debt more expensive, it also can have an impact on existing debt. Farmers that have variable rate loans face higher costs than expected when interest rates increase. In the first half of 2023, approximately 78% of non-real estate bank loans to farmers were made with variable interest rates as reported in the 2023 Survey of Terms of Lending to Farmers and Federal Reserve Bank of Kansas City.

The share of variable interest rate loans has increased considerably from the third quarter of 1981 when only 36% of these loans were variable rate. With interest rates likely going to continue to increase in the near future, it is important for farmers to consider financial risk management strategies to address these rising costs.

Financial Risk Management Strategies

There are a few strategies for managing the financial risk in agriculture. The No. 1 rule is to maintain good records. Recordkeeping is a key aspect to monitoring the financial health and financial risks of the farm. There are many different methods to keep track of financial records, including many software programs specific for farming. The best method, however, is the one that will be used and that works best for the individual operation.

The next strategy is to work with the farms lending institution. The relationship between the borrower and the lender is especially important during times when interest rates are increasing, and financial problems may develop. Communicate with the lender if there is concern about making on-time payments or there is disruption in the farm income.

Do not wait until default or foreclosure to address problems. It may be possible to obtain a lower interest rate or renegotiate the terms of the loan to something that is more manageable given the higher interest costs.

When interest rates are rising it is also a time to carefully consider capital expenditures and areas to control costs or increase revenue, including family living expenses and off-farm income. These are all risk management strategies to mitigate the financial risk faced by the farm. At the end of the day, being informed and proactive is likely going to yield the best possible outcome.

Rabinowitz is an associate professor and Extension economist with Auburn University and Alabama Cooperative Extension System.